The Turkish Competition Authority Publishes the 2021 Effect Analysis Report

| Competition Law

The Turkish Competition Authority Publishes the 2021 Effect Analysis Report

Article by Mustafa Ayna, Özlem Başıböyük and Burak Buğrahan Sezer

Competition authorities conduct various studies to demonstrate the economic effects of their activities as well as to evaluate the appropriateness of the decisions they make in accordance with the principles of transparency and accountability. Within this framework, such studies are also conducted by the Turkish Competition Authority (“TCA”). These studies, the first of which was published in 2017 and covered the three-year period between 2014 and 2016, are carried out by the Economic Analysis and Research Department and includes evaluations regarding the estimation of the measurable economic effects of the TCA’s decisions on consumer benefits.

In this context, the 2021 Effect Analysis Report ("Report") covering the period of 2019-2020 has been published on the TCA’s official website on 05.03.2021.

A Brief Overview of the Methodology Followed by the TCA during Its Analysis

The main purpose of the Report is the evaluation of the negativity that is eliminated in terms of consumers, in other words the benefits provided for consumers. In this regard, the types of decisions evaluated may be summed under three main groups: (i) cartels and similar agreements, (ii) abuse of dominant position, and (iii) merger/acquisition transactions subjected to prohibition or conditional approval.

Within this scope, the three main data under examination are (i) the turnover affected from the said decisions, (ii) the estimated rate of price increase removed or avoided through the said decisions, and (iii) the duration in which the price increase would be effective if the related violation had not been prevented.

However, it should be noted that it is not possible to provide the foregoing data in every case, and therefore the competition authorities conduct effect analysis based on certain assumptions. In this regard, at first, these assumptions that differ among the competition authorities will be included within the framework of the types of decisions evaluated.

Cartels and Similar Agreements

Whereas the assumptions being made for the three main data groups mentioned above, which are used to calculate the measurable effects of the decisions taken by the competition authorities, vary in certain aspects in the international practices, there is a consensus on certain issues.

Indeed, in terms of the turnover to be taken as a reference, while it is generally accepted that the turnover generated from goods or services affected by the cartel should be taken as a basis; changing rates (minimum 10%) are taken into consideration for the price increase and there are various approaches for the period during which the price increase will be an effective:

|

|

European Commission |

DoJ[1] |

CMA[2] |

ACM[3] |

OECD |

|

Price Increase (%) |

10-15 |

10 |

10-15 |

10 |

10 |

|

Duration (year) |

1/3/6 |

1 year or shorter |

6 |

1 |

3 |

As shown in the table above, organizations are taking different approaches in terms of duration. In this context, considering these approaches, the TCA conducts two different analysis; one of which is conservative and the other being in accordance with the OECD's "Guide for Helping Competition Authorities Assess the Expected Impact of Their Activities" (“OECD Guide”).

In the conservative scenario, calculations are made based on 1 year, while in the other they are based on a period of 3 years. However, in both scenarios, the price increase rate is 10%.

Mergers & Acquisitions

In the analysis of the effects of regulatory interventions in the merger/acquisition transactions of the international organizations, price increase estimates are made, to the extent permitted by the transaction, through concentration simulation.

|

|

European Commission |

FTC[4] |

DoJ |

CMA |

ACM |

OECD |

|

Price Increase |

Simulation |

1% |

Simulation or 1% |

Simulation or average of the previous simulations |

1% |

3% |

|

Duration (year) |

2-7 |

2 |

1 |

2 |

1 |

2 |

However, in its analysis under the conservative scenario, the TCA adopted the price increase rate as 1% and the possible duration of the price increase for 1 year, and the scenario under the OECD Guide was calculated separately. As for the turnover regarding the calculations, the turnover of the transaction parties was taken as the basis.

Abuse of Dominant Position

While the ratios based on the calculations of the international authorities vary, the European Commission does not publish the results of its effect assessment in order not to violate confidentiality due to the limited number of such decisions. However, the assumptions of other authorities are as follows:

|

|

European Commission |

FTC |

DoJ |

CMA |

ACM |

OECD |

|

Price Increase |

- |

1% |

1% |

10% |

10% |

5% |

|

Duration (year) |

- |

2 |

1 |

1 |

1 |

3 |

Remarkably, when the rates adopted by the CMA and the ACM are examined, it is seen that the abuse of dominant position and cartel agreements are considered as similar in terms of their consequences.

In light of this information, the TCA adopted the assumption of 1% for the rate of price increase and 1 year for the possible price increase period in its assessments under the conservative scenario, and made a separate assessment in accordance with the OECD Guide.

Lastly, it should be noted that; the consumer benefit calculated within the scope of the analysis does not include administrative fines imposed on undertakings in consequence of the violation decisions.

How Much Estimated Benefit Has Been Generated for Consumer in the Period of 2019-2020?

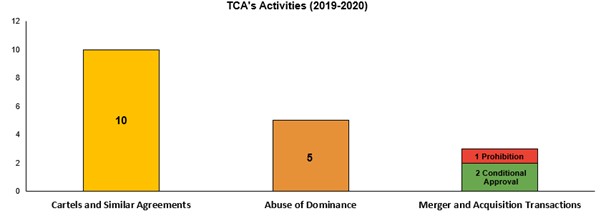

In the relevant period, the TCA ruled that actions subject to investigation constituted a violation in a total of 15 decisions of which 10 related to the cartels and similar agreements and 5 related to abuse of dominant position. During this period, the TCA also decided to prohibit 1 merger/acquisition transaction while 2 merger/acquisition transactions were conditionally approved to ensure the elimination of possible anti-competitive effects. Consequently, the estimates within the scope of this Report are based on the TCA’s said 18 decisions.

According to the Report, the estimated benefit calculated under the Conservative Scenario within the framework of the foregoing assumptions is as below:

|

Year |

Estimated Aggregate Benefit (TRY) |

|

2019 |

1.71 Billion [approx. EUR 204.7 Million][5] |

|

2020 |

2.08 Billion [approx. EUR 250.3 Million] |

|

Total (2019-2020) |

3.79 Billion [approx. EUR 456.1 Million] |

|

Average (2019-2020) |

1.89 Billion [approx. EUR 227.4 Million] |

Furthermore, the assessment made specific to the types of violations under the Conservative Scenario is as below:

|

Distribution of the Benefits Obtained in the period of 2019-2020 under Each Type of Decision (Conservative Scenario) (in TRY) |

||

|

2019-2020 Period |

Estimated Total Benefit |

Average Yearly Benefit |

|

Cartels |

3.61 Billion [approx. EUR 434.4 Million] |

1.80 Billion [approx. EUR 216.6 Million] |

|

Abuse of Dominance |

35.2 Million [approx. EUR 4.2 Million] |

17.6 Million [approx. EUR 2.1 Million] |

|

Mergers & Acquisitions |

140.2 Million [approx. EUR 16.9 Million] |

70.1 Million [approx. EUR 8.4 million] |

|

Total |

3.79 Billion [approx. EUR 456.1 Million] |

1.89 Billion [approx. EUR 227.4 Million] |

According to the Report, the estimated benefit calculated under the OECD Methodology within the framework of the foregoing assumptions is as below:

|

Total Benefit of the TCA’s Interventions over Consumers in the period of 2019-2020 (According to OECD Methodology) (in TRY) |

|

|

Year |

Estimated Total Benefit |

|

2019 |

4.79 Billion [approx. EUR 576.4 Million] |

|

2020 |

5.75 Billion [approx. EUR 691.9 Million] |

|

Total (2019-2020) |

10.55 Billion [approx. EUR 1.27 Billion] |

|

Average (2019-2020) |

5.27 Billion [approx. EUR 634.2 Million] |

Moreover, the assessment made specific to the types of violations under the OECD Methodology is as below:

|

Distribution of the Benefits Obtained in the Period of 2019-2020 under Each Type of Decision (According to OECD Methodology) (in TRY) |

||

|

2019-2020 Period - Relevant Decisions |

Estimated Total Benefit |

Average Yearly Benefit |

|

Cartels |

9.37 Billion [approx. EUR 1.13 Billion] |

4.68 Billion [approx. EUR 563.2 Million] |

|

Abuse of Dominance |

452 Million [approx. EUR 54.4 Million] |

226 Million [approx. EUR 27.2 Million] |

|

Mergers & Acquisitions |

730 Million [approx. EUR 87.8 Million] |

365 Million [approx. EUR 43.9 Million] |

|

Total (2019-2020) |

10.55 Billion [approx. EUR 1.27 Billion] |

5.27 Billion [approx. EUR 634.2 Million] |

As per the foregoing information, in both scenarios, it is understood that the greatest contribution to consumer benefit in the period subject to assessment has arisen out of the interference with cartel and similar agreements.

To Sum Up…

Within the scope of the TCA’s activities in the period of 2019-2020; (i) the average yearly estimated benefit calculated according to the conservative scenario (TRY 1.89 Billion [approx. EUR 227.4 Million]) is understood to be 15.8 times the TCA’s average yearly budget expenditure in the respective period, and (ii) when the average yearly estimated consumer benefit (TRY 5.27 Billion [approx. EUR 634.2 Million]) calculated according to the OECD methodology is taken into consideration; the resulting benefit reaches approximately 44 times the budget expenditures. As stated in the Report, the same multiples were 5.5 and 51, 6.28 and 50.75 for periods of 2014-2016, 2017-2018, respectively.

[1] United States Department of Justice.

[2] United Kingdom Competition and Markets Authority.

[3] Netherlands Competition Authority.

[4] United States Federal Trade Commission.

[5] Throughout this Report, calculations in terms of EUR are based on the year-end average exchange rate of 2020 (Euro: 8,31).