The Turkish Competition Authority Published Mergers and Acquisitions Overview Report for 2022

| Competition Law

The Turkish Competition Authority Published Mergers and Acquisitions Overview Report for 2022

Article by Sera Erzene Yıldız, Özlem Başıböyük Coşkun, Selim Turan and Naz Çerçioğlu

The Turkish Competition Authority Published Mergers and Acquisitions Overview Report for 2022

The Turkish Competition Authority (“TCA”) has published its Mergers and Acquisitions Overview Report for 2022 (“Report”) on January 6, 2023. For ease of reading, we will refer to M&As as mergers.

The Report offers an overview of the TCA’s work on mergers and provides comparisons with previous years in aspects such as (i) position of Turkish and foreign companies in the market, (ii) origins of the investors and (iii) total number and value of the transactions notified to the TCA based on sectors. As detailed below, this year has witnessed a decrease in the number of notified mergers while foreign investors have maintained their interest in Turkish markets.

Merger Reviews in Numbers

In 2022, the average review period in which the notified mergers were decided upon was 15 days following the date of notification (in case of request for information, the day in which the requested data is submitted is considered as the date of notification). Comparing to the previous year, the review period of notifications increased by four days.

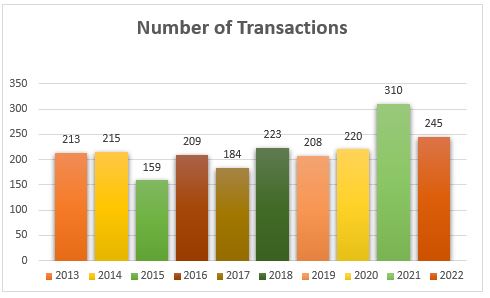

As can be seen in the Figure 1 below, number of reviewed mergers varies each year. In 2022, the TCA has reviewed a total of 245 mergers.

Figure 1: The Number of Mergers Notified to the TCA over the Past Ten Years

This year, the TCA reviewed 7 privatisation filings, same number of as the previous year.

Numbers show that there have been 310 mergers reviewed in 2021. In 2022, with an approximate decrease of 21%, the total number of reviewed mergers is 245. The statistics reveal that this is still approximately 12% higher than the average number of mergers reviewed by the TCA within the past ten years.

In 2022, the total value of the notified transactions was approximately TRY 5.7 trillion (approx. EUR 328 billion[1]), while this value was TRY 5.8 trillion (approx. EUR 554 billion) in 2021. Looking at these figures, the total value of the notified transactions seems to have remained similar in the currency of Turkish Lira. However, in terms of Euros, due to the fluctuations in the currency exchange, the value is much less than the previous year.

Among the merger filings received in 2022, the TCA identified 10 transactions that didn’t involve a change of control.

Origin-Based Categorization of the Transaction Parties

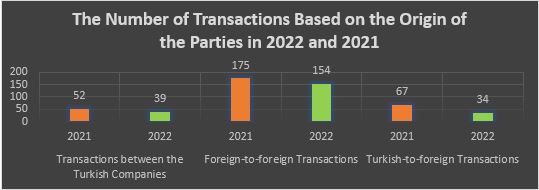

In terms of the origins, the number of transactions realised solely between the Turkish companies in 2022 was 39, approximately 33% lower compared to 2021. In parallel, the number of foreign-to-foreign transactions that the TCA reviewed in 2022 decreased by an approximate of 12% compared to the previous year (154 in 2022 while 175 in 2021).

However, the biggest difference was seen in Turkish-to-foreign transactions, with an approximate drop of 49%. The TCA received notification for 34 Turkish-to-foreign transactions, while the corresponding number was 67 in 2021.

Figure 2: Number of Transactions Based on the Origin of the Parties in 2021 and 2022

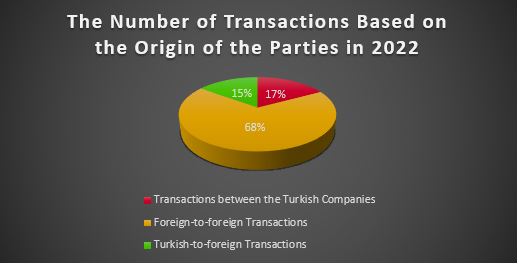

Figure 3: Percentage of Transactions Based on the Origin of the Parties in 2022

As shown in Figure 3 above, foreign-to-foreign transactions constituted 68% within all transactions and have by far the largest share. The percentage of purely local and Turkish-to-foreign transactions are almost identical.

In terms of Turkish-to-Turkish transactions, the value of the transactions increased from TRY 15.9 billion in 2021 to TRY 25.1 billion in 2022. Speaking in Euros, these figures respectively correspond to EUR 1.5 billion and EUR 1.4 billion. The value of Turkish-to-foreign transactions increased from TRY 29.9 billion in 2021 to TRY 36.2 billion in 2022. In Euros, these figures respectively correspond to an approximate of 2.9 billion and EUR 2.1 billion.

Lastly, the total value of the foreign-to-foreign transactions slightly decreased from TRY 5.7 trillion in 2021 to TRY 5.6 trillion in 2022. Speaking in Euros, based on the fluctuations on the currency exchange, the figures correspond to an approximate of EUR 544 billion and EUR 322 billion.

As also stated above, the EUR figures above are converted using the Central Bank of Turkey’s average buying exchange rate. This rate is calculated as EUR 1= TRY 10.47 for 2021 and EUR 1 = TRY 17.38 for 2022. Past two years have witnessed fluctuations in the exchange rate of Turkish Lira. This is the underlying reason for the converted Euro rates to be much less than the previous year, even though the Turkish value increase or remain similar.

Foreign Investments Maintain Significance in the Turkish Market!

As in previous years, foreign investors continued their interest in the Turkish market. On the other hand, (i) the number of countries from which investors were originated and (ii) number of foreign investors have slightly decreased when compared to 2021. Speaking of figures, investors from 16 different countries invested in Turkey in 2022, while the relevant number was 22 in 2021. Similarly, the number of foreign investors for Turkish companies was 50 in 2021 and this number was decreased to 36 in 2022.

The total value of the investment made by foreign investors was TRY 43 billion in 2022 while the corresponding value was TRY 22 billion in 2021. This means that, in terms of Turkish Lira currency, the total value of the foreign investments made to Turkish companies raised by an approximate of 95% in 2022 compared to 2021. Speaking in Euros, using the same currency exchange method as above, the figures correspond to an approximate of EUR 2.5 billion for 2022 and EUR 2.1 billion for 2021.

As per the ranks of foreign investors, the United Arab Emirates and the Netherlands are leaders with five transactions each. The United Kingdom follows with four transactions. In 2021, Luxembourg was the leading country with 10 transactions, followed by the United States of America with six transactions. It is worth mentioning that, in 2021, the TCA has only seen one investor originating from the United Arab Emirates (this number is 5 as of 2022). Also, investors originating from Czech Republic, Israel, Spain, Qatar, and Korea made investments in Turkey in 2022, although they did not have investment in 2021.

Production, Transmission and Distribution of Electricity is the Leading Market in terms of Single Transaction Value!

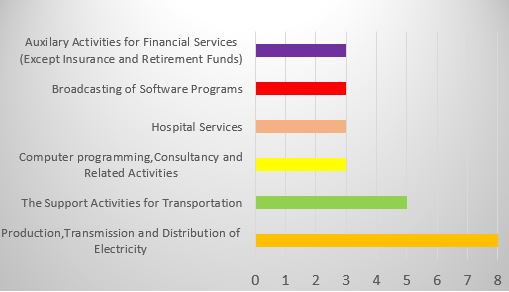

Based on fields of activity, the production, transmission, and distribution of electricity was the market where the highest number of transactions took place. There were a total number of eight transactions and the total value of the transactions in this sector corresponds to 11% of the total value of the Turkish transactions[2] (except for privatisations). Similar to the general trend, number of transactions in this field decreased by almost half (eight in 2022 as opposed to 14 in 2021).

Transportation ranked the second area with five transactions in 2022. Fields of hospital services, broadcasting of software programmes, computer programming, consultancy, and related activities and auxiliary activities for financial services (except insurance and retirement funds) shared the third rank with three transactions realised in each.

In 2022; the single transaction with the highest value realised in the production, transmission, and distribution of electricity. It involved a Turkish target, and the transaction value was TRY 8.35 billion (approx. EUR 480 million). On the other hand, transportation market had the highest aggregated transaction value with a total of TRY 20.5 billion (approx. EUR 1.18 billion).

The value-based statistics for the notified 181 foreign transactions (36 with Turkish target and 145 foreign) give an overview about the most globally invested markets, which are:

- Wholesale, retail trade, and repair of motor vehicles and motorcycles

- Programming and publishing activities

- Installation and repair of machinery and equipment

- Manufacturing of essential pharmaceutical products

- Financial services

- Manufacturing of chemical products

Figure 4: The Number of Transactions Based on the Their Field of Activities in 2022

A More Detailed Analysis…

Among the total of 245 transactions that the TCA has reviewed in 2022, only three were taken into the Phase-II. One of the relevant transactions was granted clearance while two of these are still under review.

Conclusion

The Report provides a picture of the TCA’s merger control reviews conducted in 2022. While there is a decrease in the number of notified mergers, the TCA seems to have had a very active year, with 245 merger reviews among which three turned into Phase-II investigations. Statistics also support that the foreign investors remain interested in the Turkish market.

ACTECON’s concluding remark:

Let’s remember – in May 2022, the thresholds were substantially increased to match the fluctuations in the currency exchange. The decrease in merger filings should of course be evaluated along with the recent revision in the notification thresholds. Plus, the TCA has introduced an exception for the mergers in the technology markets with a view to catch the killer acquisitions.

As the currency exchange tool, the TCA uses the Central Bank of Turkey’s average buying exchange rate realised in the previous year. So, although the thresholds were increased in May 2022, the TCA has continued to calculate the foreign currencies based on the 2021’s average rate.

As of 2023, the thresholds will be calculated based on the Central Bank of Turkey’s average buying exchange rate for 2022. This means that, while assessing if a transaction falls into the notification necessity, the exchange rate to be used, speaking for Euros will be 17.38, whereas the same was 10.47 while assessing transactions in 2022. For USD, the exchange rate was 8.89 in 2021 and the same is 16.56 for 2022. This alone shows that the TCA will be much busier with merger reviews in 2023. On the other hand, the recent exception for the technology markets will also lead the TCA to have an increased review workload for transactions involving a technology dimension.

With its 20-year of knowledge and expertise, ACTECON is excited for challenges that 2023 will bring. Please do not hesitate to contact us for any merger control queries.

[1] The EUR figures in this article, are converted using the Central Bank of Turkey’s average buying exchange rate. This rate is EUR 1= TRY 10.47 for 2021 and EUR 1 = TRY 17.38 for 2022.

[2] The transactions in which the target company was established under Turkish laws are referred to as Turkish transactions.