Highlights of the Turkish Competition Authority’s M&A Overview Report 2019

| Competition Law

Highlights of the Turkish Competition Authority’s M&A Overview Report 2019

Report Summary by Barış Yüksel, Mustafa Ayna, and Özlem Başıböyük

Mergers and Acquisitions Overview Report 2019 ("Report") was published at the official website of the Turkish Competition Authority ("TCA") on January 8, 2020. The Report provides brief information on the Turkish merger control system, comparing previous years and 2019 and determining the position of Turkish and foreign companies in the market. The value of Turkish-to-foreign transactions as well as foreign investments in the Turkish companies in 2019 indicates that foreign investors continue to be interested in the Turkish market.

A Nutshell Review of the M&A Transactions in 2019

As in most of the jurisdictions, the Turkish Competition Law mandates a pre-notification to the TCA of the M&A transactions, which involve a change of control on a lasting basis, if the turnover thresholds stated in Article 7 of the Communiqué No.2010/4 are met. According the Report, the period which the notified M&A transactions concluded by the TCA in 2019 was approximately 14 days following the date of final notification.

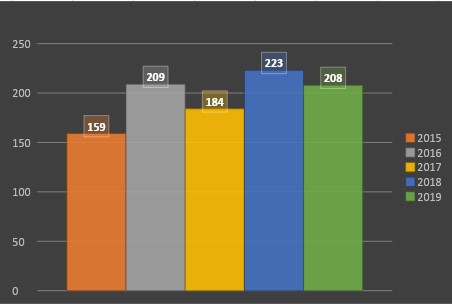

Indeed, considering the above-mentioned notification requirement, a total of 208 M&A transactions were notified to the TCA in 2019. It is seen that there is a decrease in the number of the M&A transactions notified to the TCA in 2019 compared to the number in 2018. In fact, this number was 223 in 2018.

It should be noted that the statistics for the last five years demonstrate that the numbers of the M&A transactions notified to the TCA are quite variable:

Figure 1: The Number of the M&A Transactions Notified to the TCA over the Last Five Years

As is shown from the figure above, the number of the M&A transactions notified to the TCA in 2019 shows a downward trend compared to the number in 2018. However, when the average of the last five years is considered, it is seen that the number of the M&A transactions notified to the TCA in 2019 were above the average of the last five years. Indeed, a total of 208 M&A transactions were notified to the TCA in 2019, whereas the average of the last five years was 197.

A very interesting data concerns the amount of transactions notified without any Turkish nexus (i.e. transactions that do not create any affected markets in Turkey). Transaction without a Turkish nexus amounts to 73 out of 208 transactions (35% of all transactions) notified to the TCA in 2019. In addition, it was held that 20 of the notified transactions were not subject to the authorization.

A Categorization Based on the Origin of Transaction Parties

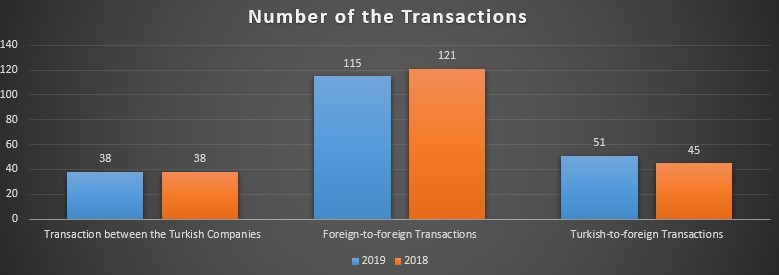

According to the categorization in terms of the origin of the transaction parties, number of transactions which were realized solely between the Turkish companies in 2019 was 38, same with 2018. As shown from the figure below, however, there was a slight decrease in the number of foreign-to-foreign transactions notified to the TCA in 2019 when compared to 2018; the number of foreign-to-foreign transactions notified to the TCA was 115 in 2019 while the corresponding number in 2018 was 121. On the other hand, transactions between Turkish and foreign companies were 51 in 2019 (compared to 45 such transactions in 2018).

Figure 2: Number of the Transactions Based on the Origin of the Parties in 2018 and 2019

In addition to the number of transactions, the value of the transactions is included in the Report as well. According to the Report, the value of the transactions between the Turkish companies declined to a considerable extent (by 41%) from 2018 to 2019. Indeed, the value decreased from TRY 10.6 billion (approx. €1.87 billion[1]) in 2018 to TRY 6.2 billion (approx. € 1 billion[2]) in 2019. However, the value of foreign-to-foreign transactions increased from TRY 2.8 trillion (approx. €494 billion) in 2018 to TRY 2.9 trillion (approx. €456 billion) in 2018. Similarly, the value of the Turkish-to-foreign transactions increased from TRY 19 billion (approx. €3.35 billion) in 2018 to 20 billion (approx. €3.1 billion) in 2019.

Foreign Investments Maintain Its Importance in the Turkish Market!

As in previous years, foreign investors continue to be interested in the Turkish market in 2019 as well. Indeed, the foreign investors from 20 different countries made investment in Turkey in 2019, while the number was 21 in 2018.

In 2019, there is an increase in the number of foreign investors invested to Turkish companies; the concerned number was 46 in 2019 while it was 36 in 2018. The ranking of foreign investors (in terms of transactions in 2019) demonstrates that Japan was leading with 7 transactions. Japan was followed by France with 5 transactions. In 2018, however, while Italy was leading with 4 transactions, whereas no investors from Japan invested to Turkish companies.

In acquisition transactions where Turkish companies were acquired, foreign investment amounted approximately to TRY 36.2 billion (approx. €5.7 billion) in 2019, while in 2018 this figure amounted to TRY 14.9 billion (approx. €2.63 billion). It should be noted that amount of the foreign investment realized in 2019 is highest in the last five years.

Top sector is the production, transmission and distribution of electricity!

Figure 3: Most Active Sectors in terms of the number of Transaction

In 2019, excluding privatizations, most of the M&A transactions were realized in “the production, transmission and distribution of electricity markets”. As of 2018, "the production and distribution of electricity, gas, steam and ventilating systems market" was the leading market in terms of the number of transactions realized.

In 2019, excluding privatizations, most of the M&A transactions were realized in “the production, transmission and distribution of electricity markets”. As of 2018, "the production and distribution of electricity, gas, steam and ventilating systems market" was the leading market in terms of the number of transactions realized.

The highest transaction value in Turkey in 2019 was realized in the field of "the activities of the monetary intermediary institutions”. The transaction value in the said area constituted 36.1% of the total value of all transactions in 2019 (excluding privatizations).

The highest transaction value in Turkey in 2019 was realized in the field of "the activities of the monetary intermediary institutions”. The transaction value in the said area constituted 36.1% of the total value of all transactions in 2019 (excluding privatizations).

Transactions Examined More Closely!

Transactions Examined More Closely!

As mentioned above, a total of 208 M&A transactions were notified to the TCA in 2019. Only two of the notified transactions were taken into the second phase by the TCA in 2019: “the acquisition of the sole control of Marport Liman İşletmeleri Sanayi ve Ticaret A.Ş. by Terminal Investment Limited Sàrl” and “the acquisition of the sole control of Embracon (a business of Whirlpool Corporation) by Nidec Corporation”.

Moreover, three transactions were conditionally approved in 2019, likewise in 2018.

Conclusion

The Report provides a clear picture of merger control regime in Turkey and determines the place of Turkish companies in the market. Foreign investors continue to be interested in the Turkish market, considering the increased value of Turkish-to-foreign transactions in 2019.